Elements Financial HSA members have access to an investment program through DriveWealth. Those who do not plan to use all of their HSA funds for current year medical expenses may wish to consider investing HSA dollars for potential added savings.

Please note: Your medical expenses can only be paid from the Elements HSA, not from your DriveWealth investment account. Therefore, funds must be liquidated from their investments and moved back to your credit union HSA in order to use those funds for expenses.

Who is DriveWealth?

DriveWealth serves as Elements' new Health Savings Account investment broker-dealer. They are pioneers in fractional trading and embedded investing, committed to transforming the investment landscape by providing fractional, transactional, and mobile investing.

DriveWealth offers a seamless investment solution with either open brokerage (self-directed) or a select list of investment offerings. You can manage the investments in your HSA with a host of modern features, including:

- Embedded investment experience within our HSA offering

- Multiple investment paths

- Real-time trades during U.S. trading hours

- Fractional shares

- Automated funding

Participation Requirements

To invest, you must have an account balance of at least $2,500 in your HSA at the time of enrollment. Eligibility does not constitute enrollment in the program. You must actively elect to enroll to use the investment funding provided to you within the Elements' HSA.

Prior to meeting the $2,500 threshold, with DriveWealth, you have the ability to pre-enroll. With our pre-enrollment option, you set your investment account details along with your investment path now before reaching the minimum amount to invest. Then, once your HSA hits the threshold needed, your investment account will be activated, and your HSA investing journey will officially begin.

Post eligibility and enrollment in DriveWealth, you’ll be able to invest any amount over your cash threshold of $2,500. If your HSA account balance goes below $2,500, you will not be able to move additional funds to your investment account.

Enrollment

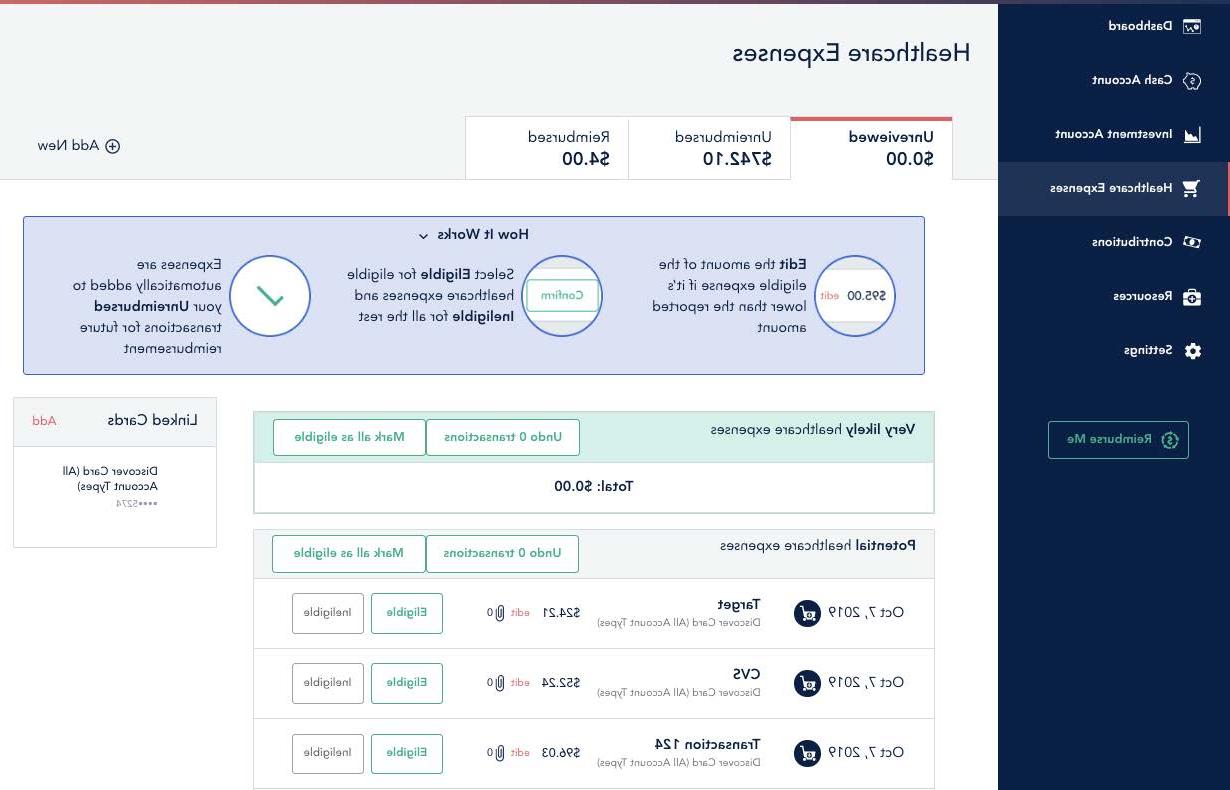

To begin the enrollment process, log into your HSA by clicking your Health Savings Account tile in Elements online banking or mobile app. From the left navigation menu inside the HSA portal, select Investment Account from the navigation bar.

The pre-enrollment screen will display a message in the event you are not yet eligible to enroll in DriveWealth. You will be able to choose your investment path and have the option to set up an automated funding sweep in advance to reach the $2,500 cash threshold.

Whether you are pre-enrolling or if you are eligible to enroll, you’ll then have access to enroll in either the open brokerage or select list investment path along with schedule an automated funding sweep if desired right from the Investment Account page that allows you to begin investing immediately upon reaching the threshold.

Both during the enrollment experience and once you’ve enrolled in your chosen investment path, you’ll be allowed to set up an automated funding sweep. With this feature, you set your investment funding threshold to any amount you choose, select the specific funds, and assign percent purchase allocations to any future contributions that exceed your desired funding threshold.

Multiple Investment Paths

During enrollment within Elements’ embedded HSA investment program, you will need to choose one of the investment paths to begin.

- Curated Fund List — Designed to simplify investment decisions and avoid the research required when self-directing investments, accountholders manage their investments by choosing from a list of preselected available funds.

- Open Brokerage — Accountholders can buy and sell a variety of investments, such as stocks, bonds, and exchange-traded funds (ETFs). DriveWealth offers around 5,500 instruments.

- Managed (coming soon) — Owned by the accountholder but managed by Bend’s Registered Investment Advisor (RIA), Alliance Benefits Group Consultants. Funds are selected based on an individual’s age and risk tolerance.

NOTE: Alliance Benefit Group, LLC (ABG) is an investment advisor firm that serves as the registered investment advisor (RIA) for DriveWealth. They are responsible for choosing and managing all funds offered in the Elements' HSA.

To manage buys and sells, visit the Investment Account page in your HSA portal and select the Buy or Sell next to the desired instrument.

You’ll see the amount that is available to invest if looking to buy, or you’ll see the amount you currently can sell and pull back into your HSA cash account. DriveWealth supports fractional share trading.

During U.S. trading times, all buys and sells are made in real-time and can be viewed as settled transactions almost immediately afterward in your Activity Tab. Buys and sells made outside U.S. trading hours will also show, but as Pending Transactions, under that same Activity Tab.

At any point, you can change your chosen investment path under the Preferences Tab within the Elements’ HSA investment account. Once a new path is selected, you will need to liquidate all previously invested funds and enroll to manage buys within the new solution.